Goldman Sachs Chief Legal Officer Resigns After Emails Reveal Epstein Relationship

Senior Goldman Sachs legal chief Kathy Ruemmler steps down after emails revealed a close relationship with Jeffrey Epstein, intensifying scrutiny of corporate governance and ethics.

A high-profile leadership shakeup at Goldman Sachs has intensified debate over corporate governance and reputational risk in the financial sector. Kathy Ruemmler, the firm’s Chief Legal Officer and General Counsel, announced she will step down effective June 30, 2026, following revelations of previously undisclosed communications and personal exchanges with Jeffrey Epstein.

The resignation comes after the emergence of emails documenting a relationship that extended for years after Epstein’s 2008 conviction for sex crimes. Correspondence described him in familiar terms and reflected a level of personal closeness that has raised questions about judgment, disclosure practices, and compliance with corporate conduct standards. Ruemmler had initially resisted calls to step down but ultimately concluded that her departure was appropriate amid escalating scrutiny.

Ruemmler’s career has spanned the highest levels of public and private sector legal authority. Before joining Goldman Sachs in 2020, she served as White House counsel to Barack Obama and later entered private practice, where some of the documented interactions with Epstein occurred. During that period, she reportedly received luxury gifts from Epstein years after his conviction, a fact that has intensified questions about ethical boundaries and internal oversight protocols.

The controversy highlights longstanding compliance expectations within major financial institutions. Goldman Sachs policy requires employees to obtain approval before accepting or offering gifts in professional contexts, a safeguard designed to mitigate conflicts of interest and avoid violations of anti-bribery frameworks. Within that regulatory environment, the acceptance of high-value gifts from a figure with a known criminal history has been viewed by governance analysts as a significant lapse in risk management.

Corporate leadership publicly acknowledged Ruemmler’s departure while emphasizing her professional record. Chief executive David Solomon described her as a respected legal authority and affirmed that he accepted her decision to resign. The company indicated that while Ruemmler regrets the association, the situation ultimately necessitated a leadership transition to preserve institutional credibility.

Newly surfaced documents have further amplified attention on the relationship’s timeline. Records cited communications between Ruemmler and Epstein through 2019, including advice related to media inquiries surrounding legal scrutiny. Law enforcement notes from the day of Epstein’s 2019 arrest also indicated attempts to contact multiple associates, including Ruemmler. Documentation attributed to the Federal Bureau of Investigation recorded statements made by Epstein at the time of his arrest that underscored his awareness of the seriousness of the charges.

The episode reflects broader structural tensions between individual conduct and institutional accountability in elite corporate environments. Financial institutions operate within complex reputational ecosystems in which executive behavior carries consequences not only for internal governance but also for public trust in regulatory frameworks and professional standards. When personal relationships intersect with professional authority, especially in sensitive legal roles, the resulting scrutiny often extends beyond the individuals involved to the integrity of the institutions they represent.

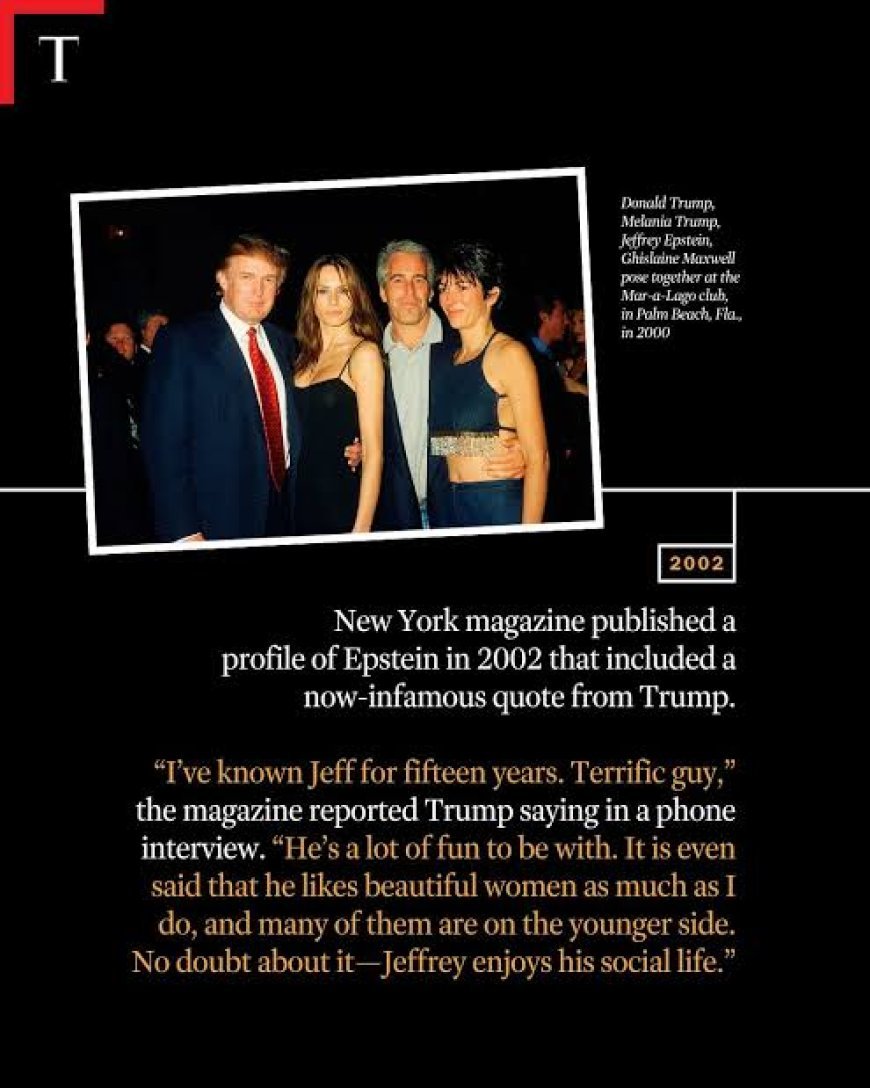

The resignation also underscores the enduring reputational shadow cast by Epstein’s network of professional and social relationships across finance, law, and politics. For corporations, association risks linked to such networks pose long-term governance challenges, particularly when disclosures emerge years after initial interactions. These dynamics have prompted renewed calls among governance experts for expanded transparency standards and more rigorous vetting of high-level corporate leadership.

As Goldman Sachs prepares for a transition within one of its most critical executive functions, the situation illustrates how reputational risk can rapidly transform into institutional risk. Leadership credibility, compliance culture, and stakeholder confidence remain deeply intertwined, and events that challenge one dimension inevitably reverberate across the others.

In the broader context of corporate accountability, Ruemmler’s departure reflects the continuing evolution of expectations placed upon senior executives. In an era defined by heightened scrutiny of institutional ethics, the threshold for reputational tolerance has narrowed, reinforcing the principle that governance credibility depends as much on perceived integrity as on formal compliance.