Inside Jeffrey Epstein’s Rise: The Financial Machinery Behind Power, Access, and Influence

An investigative reconstruction of how Jeffrey Epstein built wealth and influence, revealing the networks, structures, and opacity that fueled his ascent.

The mythology surrounding the fortune of Jeffrey Epstein has long thrived on ambiguity. For decades, the central question that shadowed his ascent into elite financial and social circles was not merely who he knew, but how he came to command the resources that made those relationships possible. An emerging investigative record reconstructs a trajectory defined less by traditional finance than by proximity to power, strategic opacity, and the cultivation of influence as a form of currency in its own right.

Epstein’s entry point into this ecosystem was neither Wall Street pedigree nor inherited wealth. It began instead with social positioning. In the mid-1970s, while teaching mathematics and physics at Manhattan’s Dalton School, Epstein was introduced to circles of affluence through the families of his students. One invitation to an art gallery event in Midtown Manhattan proved catalytic. There, Epstein encountered individuals whose fortunes were measured not merely in capital but in access — a distinction that would shape his career and the architecture of his wealth.

His transition from educator to financier occurred with remarkable speed, facilitated by connections rather than formal credentials. Epstein entered the orbit of established financial figures who recognized his analytical instincts and, more importantly, his willingness to operate within the gray zones of high-net-worth asset management. From the outset, his professional identity defied conventional classification. He did not build a widely recognized firm, cultivate a public investment strategy, or participate prominently in mainstream financial discourse. Instead, he constructed an aura of exclusivity around clients whose fortunes required discretion and whose reputations benefited from distance.

That operational model reflected a deeper shift in the late twentieth-century financial landscape, in which wealth management increasingly migrated from transparent markets to bespoke structures designed for privacy. Epstein positioned himself not as a conventional investor but as a curator of relationships — a broker of opportunities, introductions, and protections. His services appeared to hinge on a promise of insulation from scrutiny, a commodity that grew in value alongside the expanding complexity of global finance.

Understanding Epstein’s rise therefore requires examining not only personal ambition but also the institutional environment that enabled it. The late twentieth century witnessed an acceleration of financial deregulation, the expansion of offshore jurisdictions, and the normalization of wealth structures designed to obscure beneficial ownership. These conditions created fertile ground for intermediaries capable of navigating legal boundaries without visibly crossing them. Epstein’s professional persona emerged precisely within this ecosystem, one in which opacity was not an aberration but a feature.

His wealth, according to investigative findings, was less the product of conventional investment performance than of fee-based arrangements tied to advisory roles for ultra-wealthy individuals. These arrangements were often shielded from public view by private entities, trusts, and jurisdictional fragmentation. The structure mirrored a broader transformation in elite finance, where influence and information became tradable assets in themselves.

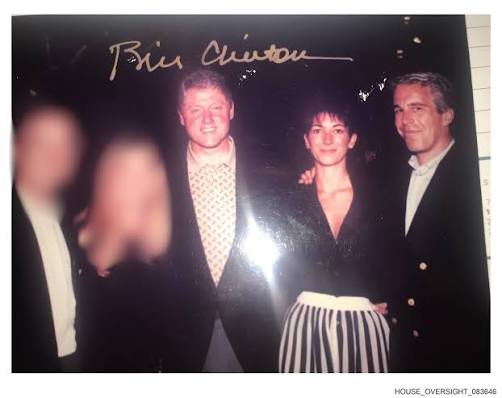

Social capital reinforced financial capital in a self-reinforcing cycle. Epstein cultivated relationships across finance, academia, politics, and philanthropy, embedding himself within institutions that conferred legitimacy. This strategy reflects a long-standing pattern in elite networks, where association can function as a form of reputational laundering. Invitations, board memberships, and philanthropic engagements generated a veneer of institutional acceptance that masked the opacity of underlying wealth structures.

The significance of this model extends beyond Epstein as an individual. His trajectory illuminates a structural vulnerability within elite systems: the capacity for individuals to leverage discretion and access into durable power absent transparent accountability. The mechanisms that facilitated his ascent — private capital networks, institutional prestige, and the absence of rigorous oversight — are not anomalies but recurring features of modern financial architecture.

Moreover, the persistence of uncertainty surrounding Epstein’s finances underscores a broader cultural dynamic in which extreme wealth often resists scrutiny through complexity rather than concealment alone. The diffusion of financial authority across private managers, offshore entities, and informal advisory roles creates a landscape in which responsibility becomes difficult to trace and oversight becomes reactive rather than preventative.

The story of Epstein’s rise is therefore not simply a biography of opportunism. It is a case study in how modern systems of wealth production can privilege access over transparency and proximity over accountability. His path from classroom to global elite status reveals the permeability of institutional boundaries when influence functions as a parallel currency.

That insight carries implications for public trust. When the origins of extraordinary wealth remain opaque, and when institutions confer legitimacy without demanding clarity, credibility itself becomes negotiable. Epstein’s financial narrative exposes the intersection of private capital and public authority as a domain where scrutiny often arrives only after power has already consolidated.

In the end, the unresolved questions about Epstein’s fortune are less a mystery of arithmetic than a reflection of structural design. His rise was made possible by systems that reward discretion, elevate access, and tolerate ambiguity when wealth and influence converge. The enduring relevance of that story lies not in its singularity but in what it reveals about the architecture of modern power.